The New Frontier: From SEO to GEO (Generative Engine Optimization)

For over two decades, Search Engine Optimization, or SEO, has been the backbone of digital visibility. Fast-forward to 2025, however, and an emerging player is taking center stage to recast the landscape of digital discovery: Generative AI.

AI-powered search innovations, including ChatGPT, Gemini, Copilot, and Perplexity, revolutionize the way users look for information. Instead of browsing through numerous pages of links, people now get direct, conversational answers generated by language models.

This evolution doesn’t mean SEO is obsolete. Rather, SEO is evolving into GEO-Generative Engine Optimization. For financial brands, the shift opens both challenges and opportunities.

Why SEO Still Matters More Than Ever

Contrary to the “SEO is dead” narrative, organic visibility remains a very important growth channel, especially for financial institutions. Whether it’s search engines or generative engines, both rely on reliable, structured, and authoritative sources.

Think of it this way:

SEO got your content found by algorithms.

GEO makes sure that your content is understood by AI models.

In other words, traditional SEO builds roads to your website. GEO makes sure those roads lead somewhere meaningful-that your brand’s knowledge and authority feed into AI-generated answers.

The Rise of Generative Search: A Paradigm Shift

Generative search is not about indexing and ranking but, rather, about interpretation, synthesis, and contextualization.

Whenever a user asks:

“What are the best AI-trading strategies for 2025?

Google’s AI Overview or ChatGPT’s search-connected models now generate an answer summarizing multiple sources, sometimes without showing the traditional blue links.

That means your brand is no longer relying on just ranking first but being referenced and cited within the AI output.

From Keywords to Knowledge: How to Adapt

1. Create Authoritative, Structured Content

The generative engines depend on context, structure, and semantics, not just keywords.

Clear hierarchy: Use H2, H3 headings, schema markup, and financial glossaries. Publish expert-level insights that position your site as a trusted source.

- Tip: Think of yourself as a data source, not just a blog. Your content should be machine-readable and factually rich.

2. Optimize for Topical Authority

Financial algorithms and AI models prefer depth over breadth.

Instead of creating dozens of small posts, focus on pillar pages that give in-depth insights into the most important topics, such as AI in trading, marketing automation in fintech, or ESG investing trends, and create supporting interlinked content clusters.

- Tip: Be the Wikipedia of your niche.

Many generative models quote structured, high-authority sources when generating answers.

3. Embrace Multi-Format Content

GEO is multimodal. The generative engines integrate text, charts, audio, and video in their responses.

Financial institutions need to invest in embedded and transcribed infographics, podcasts, and short videos-all of which improve the semantic understanding of your content.

- Tip: Repurpose long-form reports into more visual and interactive formats. AI crawlers appreciate diversity in context.

4. E-E-A-T is Still the Gold Standard

Experience, expertise, authoritativeness, and trustworthiness continue to be at the core.

For financial brands, that means touting credentials, citing sources for data, and ensuring transparency in product and performance claims.

- Tip: Use author bios, references, and compliance disclaimers. All three signal credibility to both search engines and AI models.

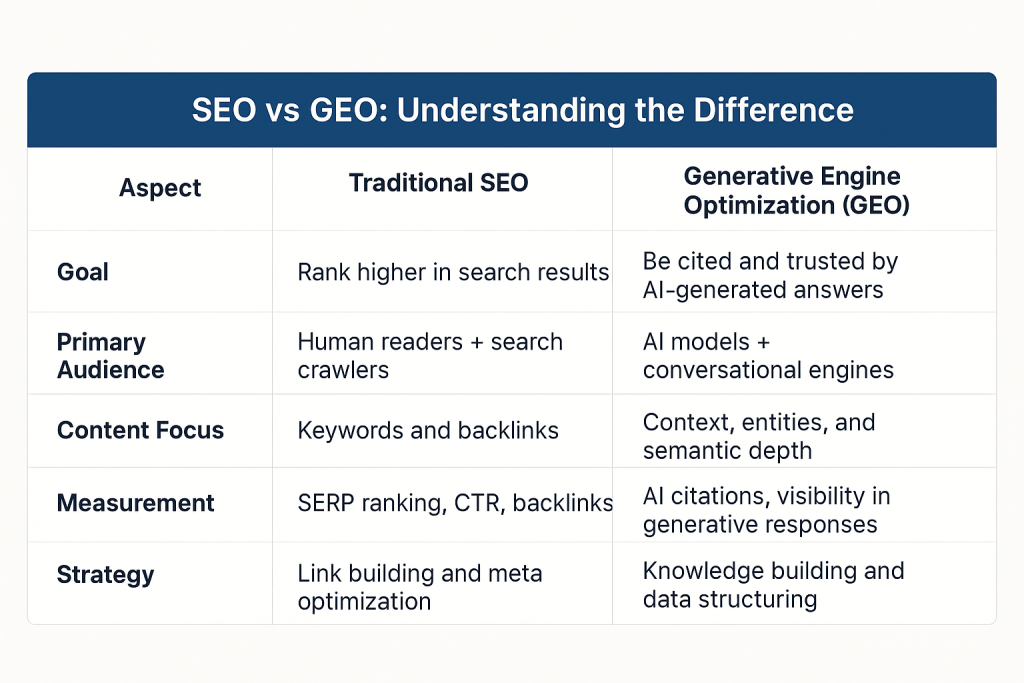

SEO vs GEO: What’s the Difference?

The bottom line: SEO gets you on the map, and GEO gets you into the conversation.

Adapting Your Marketing Strategy to the GEO Era

Financial marketers must now think in AI ecosystems, not just search engines. Here’s how to stay ahead:

Financial marketers should now think in AI ecosystems, not just search engines. Here’s how to stay ahead:

- Integrate SEO + AI content strategies, Optimize not only for Google but for AI assistants that use web data to answer queries.

- Leverage structured data, Use schema markup for products, financial terms, FAQs, and reviews.

- Track AI visibility, Emerging tools (e.g., AlsoAsked, SEOClarity AI tracking) now monitor mentions within generative engines.

- Maintain human insight, AI can generate summaries, but human perspective builds trust. Combine automation with expert commentary.

Collaborate with marketing agencies specialized in finance + AI, Agencies like FinancialMarkets.media bridge technical SEO, content strategy, and AI adaptation for financial institutions.

Conclusion

The Future Belongs to Adaptive Marketers SEO is not dying; it’s evolving. Generative AI is rewriting the rules of visibility. Those financial institutions that adapt now-combining classic SEO fundamentals with AI-driven optimization-will be leading through the next era of digital trust and authority. Marketers who understand both how humans read and how AI interprets will own the future of financial visibility.

At FinancialMarkets.media, we believe the key to staying relevant in this new landscape isn’t abandoning SEO; it’s redefining it for the generative era.